How to calculate the payback period?

The payback period measures how long something takes to “pay for itself.” It is an economic method that measures the time to recover the initial investment or extra investment and is useful and quick for alternative investment evaluations.

Real values vs Present values - 2 ways to calculate the payback period

REAL VALUES (NON-DISCOUNTED)

- Doesn’t take the time value of money into account.

- Simple to calculate, gives a good general overview.

PRESENT VALUES (DISCOUNTED)

- Takes time value of money into account, which means that a sum of money in the hand has greater value than the same sum to be paid in the future.

- More complicated to calculate. Gives a more precise overview.

Let's give an example

Purchasing solar panels and calculating their Payback period with an assumption that cost of purchase and installation is €10,000, will save on average €1000 of energy bills each year. Otherwise, the yearly inflated interest rate (from a bank, investment, with inflation) would be 3% in case the investment would not be put into solar panels. Let’s assume there are no maintenance costs.

REAL VALUES (Simple payback period)

€10,000 / € 1000 = 10

10 years payback period

PRESENT VALUES (Time value of money considered)

With our example: The total present value of the incoming cash flows would be €8529,6. The total present value of the outgoing cash flows would simply be the €10,000 investment at time t = 0.

NPV (net present value) = Present value benefits – costs

NPV = €8529,6 – €10,000 = – €1470,4

This means the NPV should be discounted

€10,000 (initial investment) -(-€1470,4) = €11,479,4

€11,479,4 / €1000 = 11,48

Payback period of approx. 11 years 6 months

How to calculate savings after the payback point?

Simple method: Take the lifespan of the product/material, subtract the payback period and multiply it with the cost of “scenario B”.

Example: Solar panels with payback period of 10 years. Otherwise, an average yearly energy bill of €10,000. There would be no maintenance costs.

- Lifespan of solar panels = 30 years

- Extra years of savings = (30-10 years payback period) * €1000 average bill = €20,000 in extra savings

PS! This method is simplistic and does not calculate costs nor inflation that also influence energy prices and average yearly bills.

Examples from the payback period method

As it is a simple comparison method, it is easiest do apply with options that have specific costs (or extra cost). To bring some examples:

ITEM

EXTRA COST

COST OTHERWISE

PAYBACK PERIOD

WHAT IS NOT INCLUDED

Solar Panels

€10,000 initial investment

€1000 per year for electricity

10 years

Savings afterwards, environmental sustainability, maintenance

Smart house

€5000 initial investment

20% savings on energy (€200 per year)

25 years

Convenience, extra cost for security, savings afterwards

Air-con

A+++ vs A energy class

Aircon A (1000 kWh per year, A+++) = €1500

Aircon B (1500 kWh per year, A) = €1200

1 kWh = €0.2

Aircon A = 1000*0.2 = €200

Aircon B = 1500*0.2 = €300

(€1500-€1000)/(€300-€200) = 5 years

Environmental impact

A comparison can be made with any device or material if the cost and the lifespan is known. Ideally also the cost of maintenance, which could be added and would make the calculation more precise.

What to consider when using the payback method?

Both, discounted and non-discounted calculation methods generally ignore the costs and savings after the payback point!

It doesn’t consider overall savings as the best option should always be the one with the shortest payback period. It can happen that an investment with a shorter payback period is a worse option than one with a longer pay-back period. E.g. a buying a solar panel with a life span of 20 years which costs less (quicker payback time) rather than one with 30 years life span which would have a higher total savings rate.

It is very simplistic. The payback period Is in most cases not realistic and accurate when used as the only method (especially with non-discounted calculation) and it does not consider any other factors than direct costs.

Other methods for analysis of alternative choices

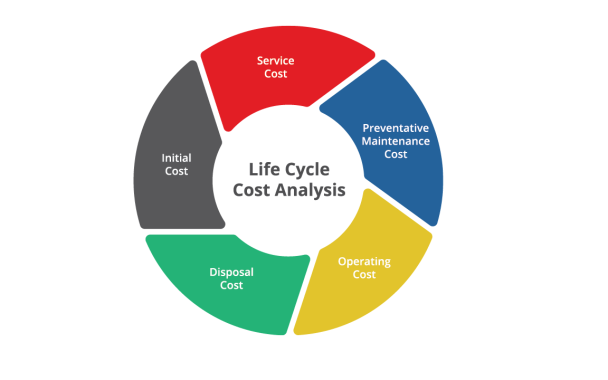

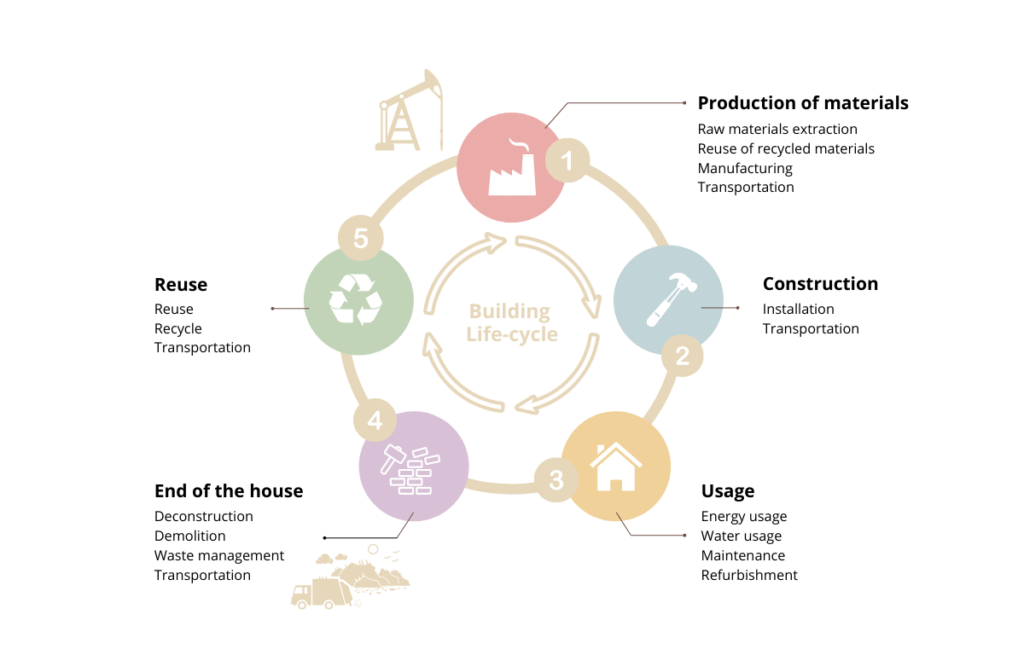

Economic quantitative analysis

Economic quantitative analysis refers to methods where the bottom line is money. Examples are: life-cycle cost analysis and cost/benefit analysis.

Environmental quantitative analysis

Environmental quantitative analysis refers to methods that measure the level of pollution that certain activities cause. Examples are: Life cycle analysis of greenhouse gas (GHG) emissions, energy efficiency analysis (nearly zero energy building concept as an example) etc.

Tailor made qualitative analysis

Qualitative analysis, where the variety of variables and questions is wide and there is no one standard measurement to apply. Qualitative analysis focuses on how and why events happen without using numerical data. Examples are: social sustainability analysis, health and wellbeing analysis etc. Let’s give an example thesis that should be qualitatively analysed: “Does living in rural areas improve people’s health and wellbeing”.